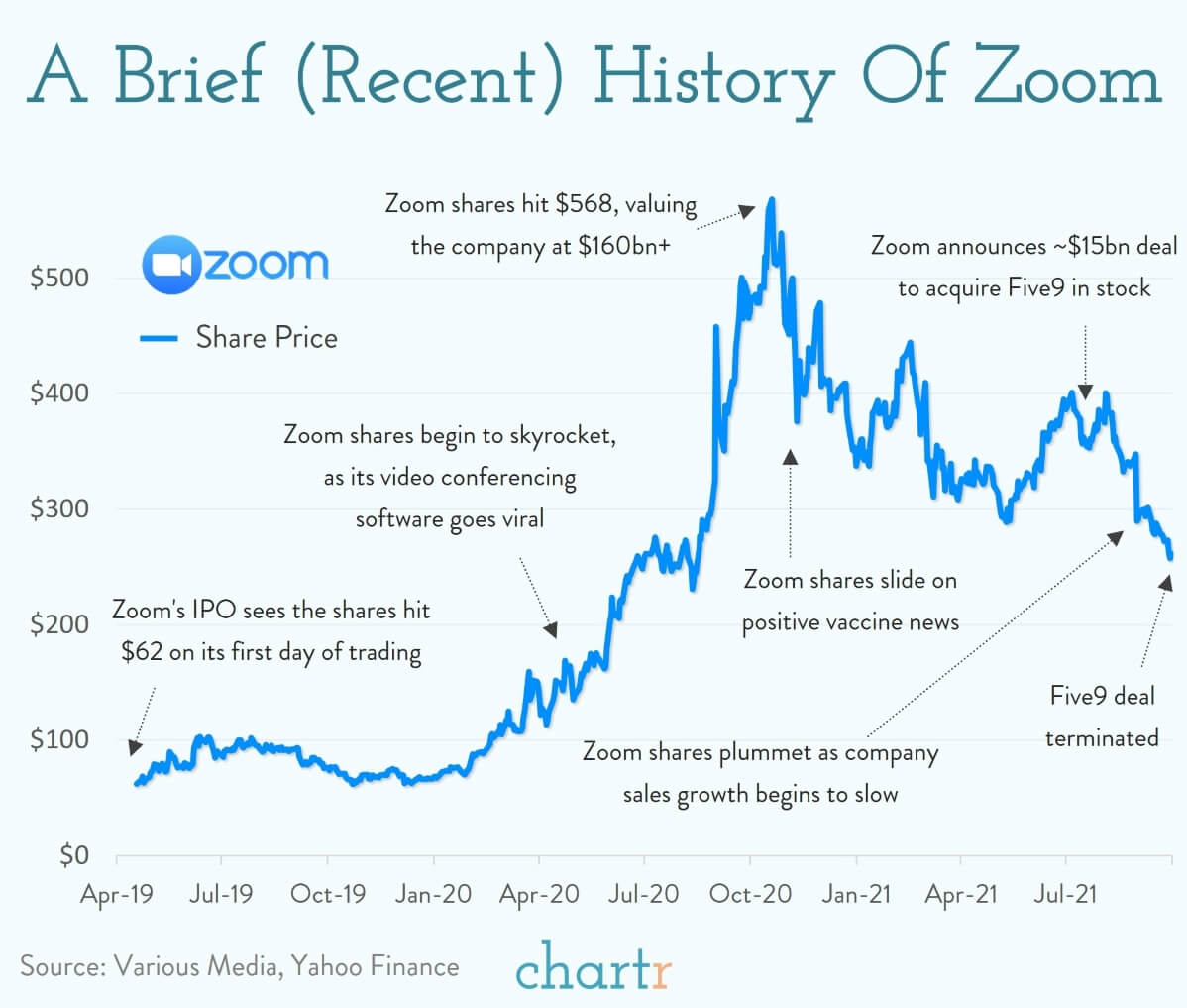

Zoom has officially given up on its $15bn deal with Five9 — a cloud contact center that it initially reached an agreement to purchase in July.

The deal fell through after Five9's shareholders voted against the acquisition, marking another blow to Zoom which has had something of a tougher time in 2021 than it had in 2020.

Five9 shareholders were promised roughly 55 Zoom shares for every 100 of their Five9 shares. The problem is that since the deal was first slated, those 55 Zoom shares are now worth about 25% less than they used to be worth — making the deal substantially less attractive.

Great expectations

As we turned to Zoom for work, trivia quizzes, murder mystery nights, weekly catch-ups and just about everything else during the start of the pandemic, investors expected Zoom's financial performance to explode. And it really did —just apparently not enough to meet those lofty expectations.