Hi! Apple is expected to reveal its new iPhone 14 today, it’s rumored they’re ditching Minis and going all in on their larger models — all the better for reading charts on. Today we explore:

This week Volkswagen confirmed its intention to float shares in Porsche in the coming weeks — an IPO that, if it comes off, would be one of the largest in recent European history.

Porsche in proportion

Analysts are valuing the company at anywhere between $60bn and $85bn ahead of the proposed listing, though it's difficult to overstate how precious a jewel in VW’s crown the sports car maker is.

Within the vast Volkswagen Group portfolio, Porsche and Audi are the two biggest profit engines by some distance. However, when compared to VW's passenger car division — which sold 2.7 million vehicles last year — Porsche's production is small. The iconic brand sold just ~300k cars but, thanks to an average selling price of around $100k and a lean cost base, Porsche produced roughly 2x the operating income of the mainstream VW brand.

Keeping it in the family

Although just 12.5% of the total shares will be sold to IPO investors, the listing should give VW Group more financial firepower to complete the costly transition to electric vehicles.

The Porsche-Piech family, made up of direct descendants of the founder, will end up owning some 25% of voting shares in the company. They'll be hoping that Porsche shares will race higher as a result of the public listing, just like Ferrari's did in 2015 when the Italian company was spun out from its parent company, Fiat Chrysler.

Selling out

More than 8 million moviegoers were drawn in by the glow of their local silver screens last Saturday as $3 tickets were offered up at theaters across the nation, resulting in the busiest day for cinemas in 2022. Independent picture houses and national chains like AMC and Regal chipped in to celebrate America’s first National Cinema Day, offering discount deals across some 30,000 screens.

Roll credits

Though box office revenues have risen in recent years — largely due to inflation bumping the average movie ticket price up — actual ticket sales have been dipping ever since the golden age of admissions back in 2002, when 1.6 billion movie-lovers rushed out to see films like Spider-Man and Star Wars Ep. II. National Cinema Day offered a much-needed injection of interest for the big screen, but the cinema industry at large is still struggling to recover post-pandemic. The world’s second-largest chain Cineworld remains on the brink of bankruptcy thanks to an enormous debt load and a dearth of blockbuster offerings.

In a reflection of the relatively quiet release schedules, Top Gun: Maverick won the Labor Day weekend after pulling in $7.9m. The same film broke Memorial Day records when it was first released back in May — making it the first movie to be #1 at the domestic box office across both weekends.

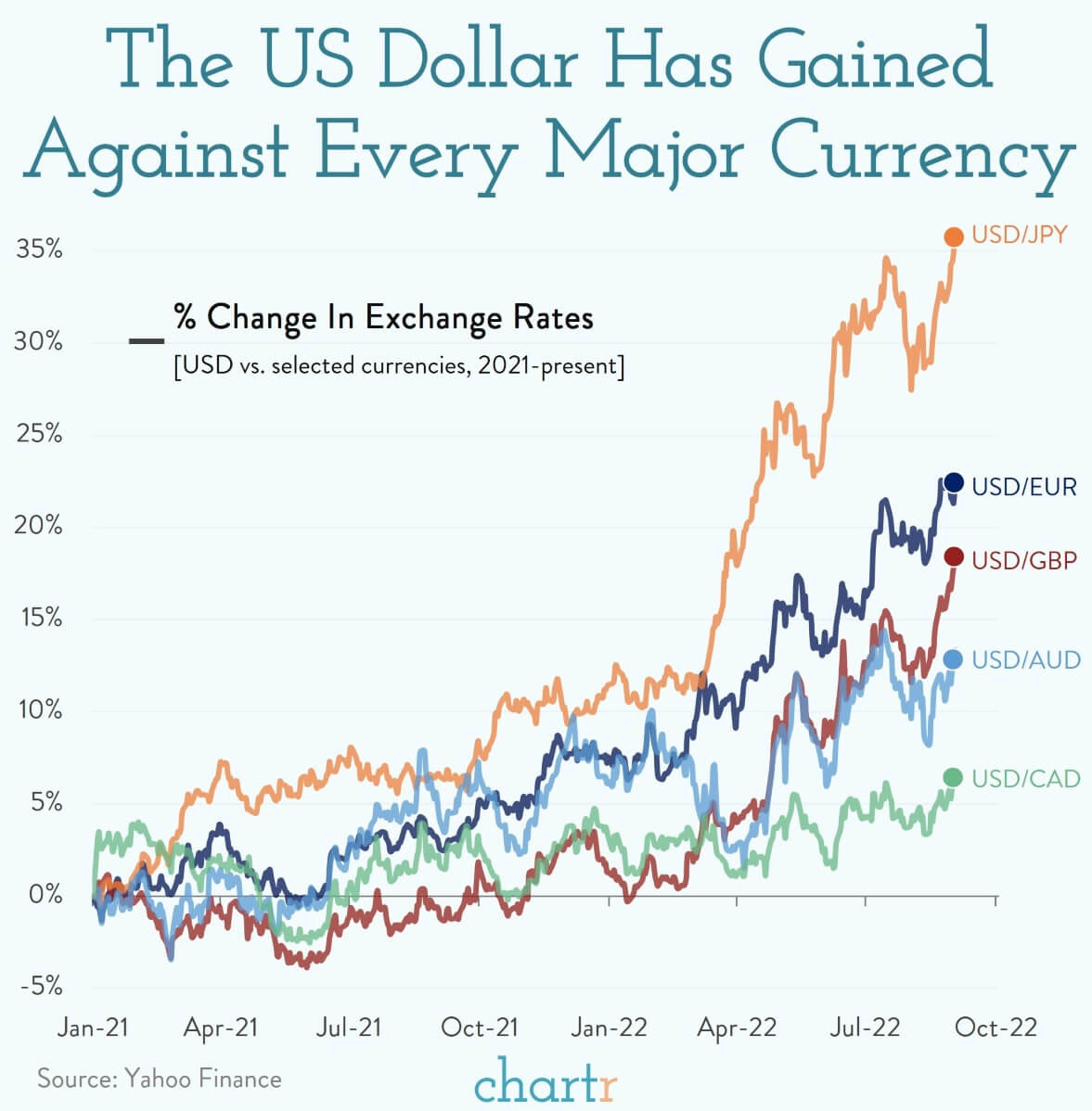

I need a dollar, dollar

The dollar in your pocket might buy a little less at the grocery store thanks to inflation, but if you travel abroad you may actually find it going further than you expected, as the US dollar continues to strengthen against other major currencies.

At the time of writing, one euro is worth just $0.99, a two-decade low for the European currency, while one British pound is worth just $1.15 — the lowest level for GBP since 1985. The recent moves follow a stand-out performance for the dollar in August, when it was the second best-performing global asset for the month only behind natural gas.

Ahead of the curve

The Federal Reserve's continuing support for steep interest rate hikes, in a bid to curb inflation, has been more aggressive than in other regions. That's been attractive to investors seeking higher rates on their cash, and is likely to continue given the Fed's firm stance on taming inflation.

A stronger dollar isn't strictly a good, or bad, thing. Importing goods from abroad is now relatively cheaper for Americans, but if you're selling abroad your prices are now likely less competitive than they were a few months ago.

Interestingly, USD isn't the best performing global currency — the Zambian Kwacha has gained 18% against the dollar this year.

• Air travel is back. Labor Day saw the TSA screen 8.76 million people from Friday to Monday, topping the same weekend in 2019.

• Does the Monopoly Man really wear a monocle? This YouGov polling measures the Mandela effect.

• Inflation, gas prices, politics, entertainment, weather, travel — you name it, there’s a market for it on Kalshi. Trade the future on specific events on the world's first fully CFTC-regulated exchange.**

• Kate Bush’s Running Up That Hill was the song of the summer in the US, where first time listens from Gen Z soared some 7,800% according to Spotify.

• Russia has cut off gas supplies to Europe via the Nord Stream 1 pipeline, compounding the continent's energy woes.

• Liz Truss has become the UK’s 3rd female leader and the 15th prime minister to serve under Queen Elizabeth II.

• Conversing with cacti: a new survey found that 48% of people talk to their houseplants.• Is democracy sliding backwards? A study from Our World In Data.

**This is sponsored content.