Happy Easter weekend folks, 3 charts for you today exploring:

Retail investors have made headlines repeatedly this year, most notably for trading in shares of GameStop. But for every GameStop success story, there's a buyer of a penny stock somewhere else, who probably has no idea what they just bought.

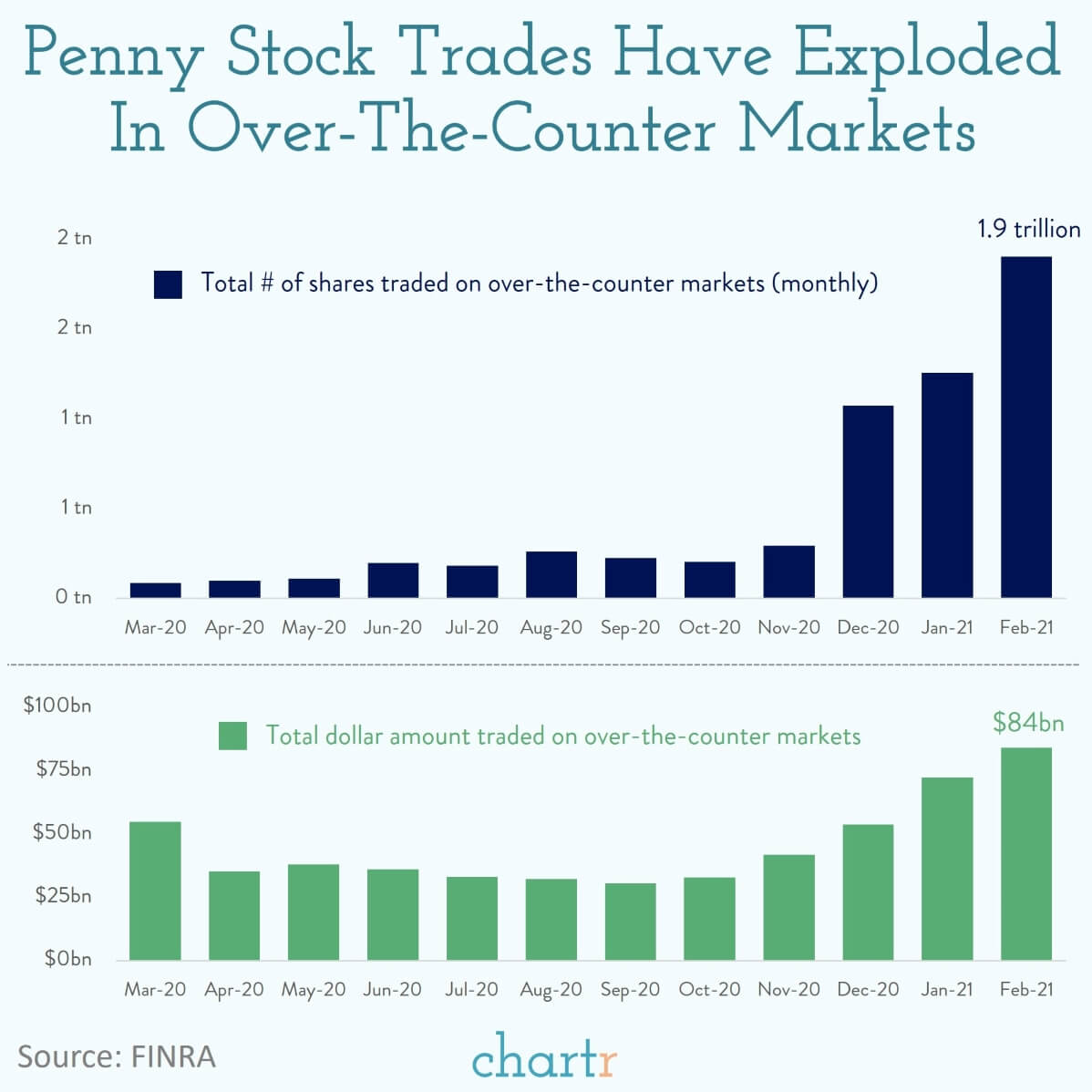

Data from the Financial Industry Regulatory Authority reveals that more than 1.9 trillion shares changed hands in February on over-the-counter markets in the US. That's up more than ten-fold on the typical monthly volumes seen last year.

Sell me this pen

The average dollar cost per share for February in OTC markets was just $0.04, strongly suggesting that the vast majority of these trades are for penny stocks, potentially similar to those that Jordan Belfort infamously sold in the Wolf of Wall Street.

Securities traded in over-the-counter markets are generally less scrutinized than those on standard market exchanges like the New York Stock Exchange. Disclosures for those companies are less rigorous, if updated at all.

Trading penny stocks, where prices can move dramatically on just a few trades, promises large fortunes to those with little patience. The problem is that there are few protections for investors, and few ways to research what you are being sold. As Warren Buffett has often opined, nobody wants to get rich slow.

This week 2 payments giants made big announcements about their intentions for cryptocurrencies.

Visa revealed that it would allow users to use USD Coin, a cryptocurrency tied to the value of the US dollar, to settle transactions on its payment network and PayPal announced that US consumers would be able to use their cryptocurrency holdings to pay for items from millions of online merchants.

Cash, credit or crypto?

This is a fairly big deal for cryptocurrencies generally, but it's also a big moment for the legacy payment providers. Visa and PayPal are among the largest US payment firms, along with Mastercard and American Express — and all of them are trying to position themselves to best capture the increasingly digital way that we pay for... stuff.

From 2011-2019, those 4 payments companies all grew their revenue consistently, but last year the 3 largest card companies saw revenue fall, as consumers spending on credit and debit cards dried up. PayPal however grew 20%, as the facilitator of choice for millions of online, rather than physical, merchants.

Whether Visa or PayPal management seriously believe in cryptocurrencies as the future of payments, or whether these features are just a way to hedge their bets a bit, isn't clear. What is clear is that there are a lot of companies that want to take their, very sizable, lunch (these 4 companies did $85bn+ of revenue last year alone). Competition in payments is only going to intensify from here.

This week the state of New York legalized the use of recreational marijuana, becoming the 15th state to do so. With the 19 million people living in New York State added to the total, it means that approximately 130 million Americans now live in a state where marijuana use is legal.

Slow, then fast

Public opinion on legalization has changed significantly in the last 50 years, and attitudes have changed most notably since the turn of the millennium. In 1973, just 19% of those polled believed marijuana use should be made legal, by 2000 that had crept up to around 30% of those polled, but by 2019 that number was 67% — roughly a two-thirds majority (data from Pew Research Center). The shift in attitudes gathered substantial speed since Colorado and Washington became the first states to legalize recreational use, back in 2012.

Something new to tax

Legal weed means that the state government can also tax any legal sales. In New York, the debate around what to do with those tax revenues was arguably the most contentious of the entire issue. In the end lawmakers compromised that 40% of the tax revenue raised would be earmarked for communities that had been most adversely affected by prior marijuana arrests. The vast majority, more than 94% last year, of those arrests were Black or Latino individuals.

1) US home prices have risen at the fastest pace for 15 years, reportedly rising 11% in the last 12 months.

2) Mr. Brightside, a song released by The Killers back in 2003, has now spent the last 5 years inside the UK's Top 100 chart, being streamed on average 1.2 million times a week.

3) Nike has won its lawsuit with MSCHF over the $1,018 controversial "Satan Shoes". A judge issued a temporary restraining order despite MSCHF's insistence that the shoes were "works of art" that were sold to collectors.

4) Microsoft has won a contract that could be worth up to $21.9bn to provide the US Army with 120,000 augmented reality headsets.

5) Find Amazon overwhelming? Here’s a free tool that does extensive product research for you — from reviews to prices — so you always get the best product & price. Get Lustre here. It’s 100% free.**

**This is a sponsored snack.